How Grab grew from a small taxi hailing app to the crown jewel of Singapore valued at nearly $40B+

This mini-series will explore the rise and anatomy of Super Apps in Asia and what the west can learn. We’ll be diving into the rise of Grab, Alipay, and WeChat and analyzing the biggest up and coming super apps in America.

Subscribe to stay updated and get those insights before anyone else.

What is a super app?

WeChat, Gojek, Grab, Alipay. All of these apps rose to power and quickly became known as ‘Super Apps’. Being used by hundreds of millions of users and powering everything from ride-sharing to e-commerce.

A Super App is a platform that has an ecosystem of apps within it. They aim to become the ‘operating system’ for a certain aspect of someone’s daily life. Whether it’s logistics & planning, your social life, the functioning of your home, or taking care of your health.

Some examples are:

Grab: Lets you find rides, book hotels, orders groceries, make payments, buy movie tickets, and stream video.

Alipay: Lets you send money, pay bills, buy products, get loans, invest spare cash, and buy insurance.

WeChat: Lets you chat with friends, send money, play games, buy products, follow influencers, and find people to date.

How did these super apps start?

We’ll be doing a mini-deep dive on how these super apps rose to power. Subscribe to stay updated on when the come out!

Grab (below)

Alipay (coming soon)

WeChat (coming soon)

Grab: Singapore’s first ‘decacorn’ (+$10B Valuation)

Grab started as a taxi app focused on ride hailing in Malaysia a few years after Uber and Gojek. Now, it’s the go to app for planning your life and valued at an estimated $40B. On Grab you can do almost anything including getting a ride, organizing grocery delivery, trip planning, paying bills, delivering packages, streaming video, and booking hotels.

Over the past few years Grab has exploded from a humble taxi-hailing app to the #1 place for users in South East Asia to plan their lives. They used concepts pioneered in China and created a playbook to turn a ride-sharing app into a super app worth billions.

This playbook is being used all over emerging markets with companies like Bykea and even even here at home with Uber.

Lets break this down further

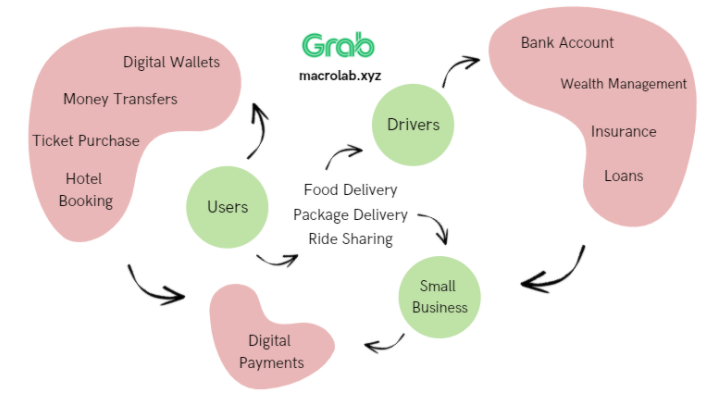

Grab’s focus has traditionally focused on two core parts of its marketplace, drivers and riders, before adding a third (small businesses) in the past few years.

Grab was founded in 2012 by Anthony Tan and Tan Hooi Ling. At the time, it was notoriously difficult to hail a taxi and was often unsafe for women who needed to travel at night.

At the beginning, Grab partnered with taxi-companies to create a taxi hailing app that users could use to order a taxi and get from point A to point B safely. Using local partnerships as their leverage, they expanded quickly throughout South East Asia dominating their niche vertical before Uber could enter the market (Uber did end up entering South East Asia but sold their business line to Grab).

In 2014 they launched GrabCar – a copy of Uber, and then quickly expanded into GrabBike (two-wheelers) and GrabShare (carpooling). Both of which appealed to price sensitive users.

Then Grab stumbled across a gateway that would propel them from being a ride-sharing app to the super app we know today – payments.

“I remember Grab’s early days when we’d meet driver-partners, one at a time, to help them set up their first bank accounts. We wanted to help them break out of this vicious cycle. Since then, we’ve launched our Grab Financial Group to offer financial services like payments, insurance, financing and wealth management to our customers and partners”

– Tan Hooi Ling, COO & Co-Founder

In South East Asia, many customers would typically pay cash for services. Bank accounts and credit cards aren’t nearly as common as they are in the west. This allowed Grab to launch GrabPay in 2016. A service that would allow customers to use QR-codes to transfer money.

They started with taxi payments on their core app but then quickly pushed GrabPay to stores and small businesses.

By focusing on the problems that drivers and users experienced, Grab was able to bootstrap demand in a few key areas.

Finance: The majority of Grab’s drivers had never had a bank account before. This allowed Grab to create a financial system built for drivers. It allowed them to store their fares, purchase micro-insurance for their cars, and take out loans for their new smartphones. By implementing digital wallets on the user side and striking partnerships with local stores and grocery chains, they were able to introduce a new utility for users.

Delivery: Following the footsteps of Gojek and Uber, Grab used its existing transportation network and demand from users to introduce GrabShare (carpool), GrabExpress (package delivery), GrabFood (food delivery), and GrabMart (Grocery Delivery).

Entertainment: With users now utilizing their digital wallets, Grab doubled down on purchase frequency offering ticket purchasing, travel planning, hotel booking, and movie streaming into its core app. Allowing users to use Grab to plan the logistics of their social lives.

The key to doing this relied on a few core strategies

High-Frequency Usage: Grab’s core ride-sharing functionality is a high frequency service. Users were opening the app multiple times per day to book rides. By leveraging this attention, Grab was able to increase this frequency by offering more related services that use their core infrastructure, like food delivery and package delivery. Capturing more value from users with a $0 acquisition cost (because they’re already opening the app). This created an attention flywheel where users would spend more and more time on app.

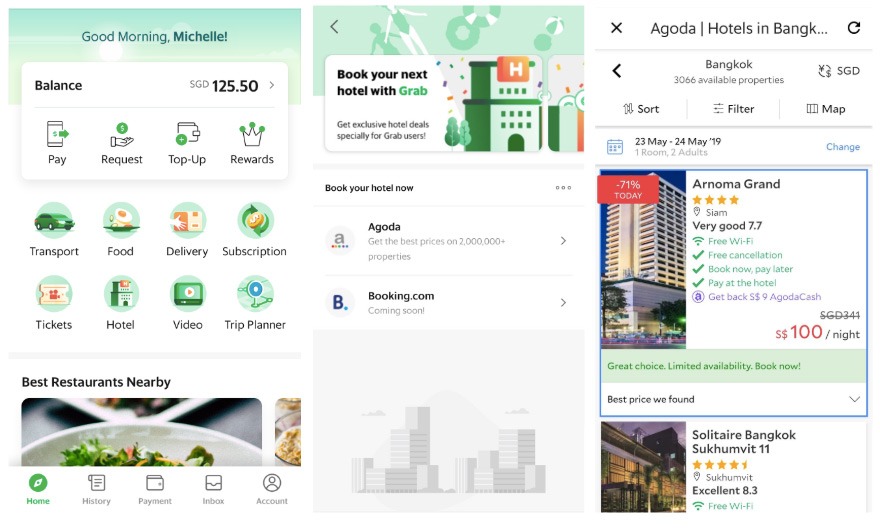

Partnerships: Building new product lines can be costly. Especially ones that are low-margin. But partnering with other companies who already have the infrastructure decreases risk. To launch grocery delivery, Grab partnered with HappyFresh a Indonesian-based grocery delivery service. To launch hotel bookings it partnered with Booking.com, for travel planning – Agoda, and for bill payments – OVO. This allows them to deepen the value they provide users and increase ARPU (Average Revenue Per User) without heavy overhead.

A Clean Playing Field: The market in South East Asia when it comes to tech was nascent. It did not have the same entrenched market leaders we have in the west. When Grab started, most taxi drivers didn’t have bank accounts. So the majority of transactions were done in cash. This allowed them to introduce bank accounts to drivers and introduce a new form of digital payment through their app. It also allowed them to expand the utility of their payment plan to be used at shops and other small-businesses.

Core Concepts in the Super App Playbook

Core to Grabs meteoric rise are four key strategies:

The Market Network Effect

Super apps start with a high-frequency niche and expand vertically. The demand from one area of the platforms bootstraps the demand for another. With Grab, the demand for digital payments from users bootstrapped the demand for GrabPay. The demand for better financial service from drivers allowed them to create a thriving ecosystem of services like bank accounts, insurance, loans, etc. The same logic ca be applied to trip planning and hotel booking – especially for users who were using Grab to plan their travel in a new city.

NFX wrote a great article on market network effects here

Frequency

Super apps start with something high frequency. Then they try to deepen that frequency and broaden the use cases that you use the app for. With the goal of becoming ‘the operating system’ for your everyday life. With Grab, they started with ride-sharing, but then expanded into food delivery, package delivery, grocery delivery, payments, and trip planning. All with the goal of becoming the way that you organize your life’s logistics. This allows them to deepen their average revenue per user (ARPU) by leveraging assets they already have. It also allows them to create a attention flywheel – where you increase the frequency of users on your app by providing more valuable services for them to use. This creates more attention from users that can then be leveraged to provide more services.

Connie Chan from A16Z talks about the power of high frequency apps here

Adjacent Vertical Expansions

The same way that empires capture key cities to expand their economies in new verticals (ie. Rome capturing Constantinople to expand their trade offerings), tech companies can capture key ‘gateways’ to expand into new verticals. Chat expands into entertainment and money transfers. Digital wallets expand into loans, insurance, and wealth management. Health expands into diet, fitness, and insurance. Although like Constantinople, these gateways are heavily protected and very challenging to break into. But if they’re captured, they can reap huge rewards.

(I’ll be writing more about this soon – subscribe to stay updated)

A Clean Playing Field

The reason super apps have taken off in emerging markets is because there aren’t entrenched players in each vertical. When WeChat expanded into social money transfers, there wasn’t anything like it in the market for quickly sending money to friends. When Grab expanded into digital payments, most drivers didn’t even have bank accounts. This allows super apps to quickly capture market share by leveraging the demand they already have. This is the main reason why we haven’t seen the same level of super apps here in the west….yet.

TechinAsia did a good analysis on why super apps haven’t come to the west yet here

What super apps are on the rise in other countries?

Emerging markets meet the ‘clean playing field criteria’ I described above. Many newly-minted unicorns in the region are following the playbooks that their Asian counterparts, like Grab, have laid out. But with a local flair.

A great example is Bykea – a ride-sharing app in Pakistan that recently raised a large Series A and has already expanded into bill payments, cash delivery, and food delivery. My friend Dianna did a podcast with their COO on how they leveraged localization to beat out Uber.

List of super apps in India & Pakistan

Jio + WhatsApp (e-commerce + chat)

PayTM (payments)

PhonePe + Flipkart (e-commerce)

Bykea (ride sharing)

List of super apps in Africa

JumiaPay (ecommerce)

OPay (payments)

List of super apps in LATAM

Rappi (food delivery)

Mercado Pago (payments)

Moville (food delivery)

Cabify (ride sharing)

Will we see super apps in the west?

Uber, Facebook, Shopify, and Square and adopting practices from the east and are the closest in moving moving towards becoming super apps for their niches.

Since they don’t fall within emerging markets (aka. the theme of this newsletter), I’ll be writing about them on my LinkedIn and Twitter. Follow me there to stay updated! I’d also like to plug a brilliant article written by East Meets West on Square’s super-app strategy here as a starting point.

Conclusion

Super apps rely on the market network effect and partnerships. They supplement high-frequency, low-margin businesses with additional services to increase the amount of revenue per user. We’re going to see new super apps pop-up all over untapped emerging markets using their keen understanding of culture and user behavior to ward off bigger competitors.

If you liked this article, please consider giving it a “❤️” on Substack or subscribing using the button below!