The esports and mobile gaming industries in India is one of the fastest growing markets in the world. It’s on track to surpass than the music, movie, and television industries put together.

Hello, I’m Daniel and welcome to Macro Media Lab! Twice a month I tackle some of the largest trends in emerging markets and break them down so you can understand how the world is changing.

This weeks report is on the e-sports industry in India.

The Quick Summary

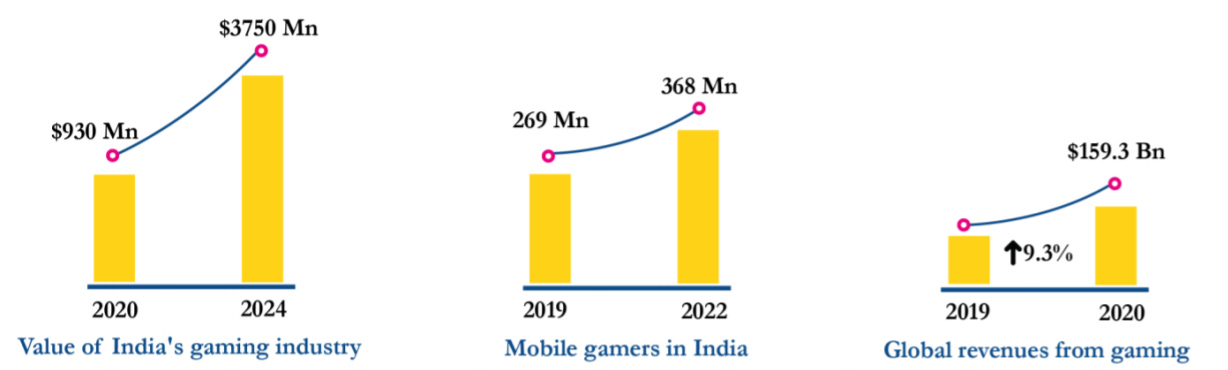

- The esports industry in India is expected to 3.7x over the next 4 years. Growing from $935M USD to $3.7B USD.

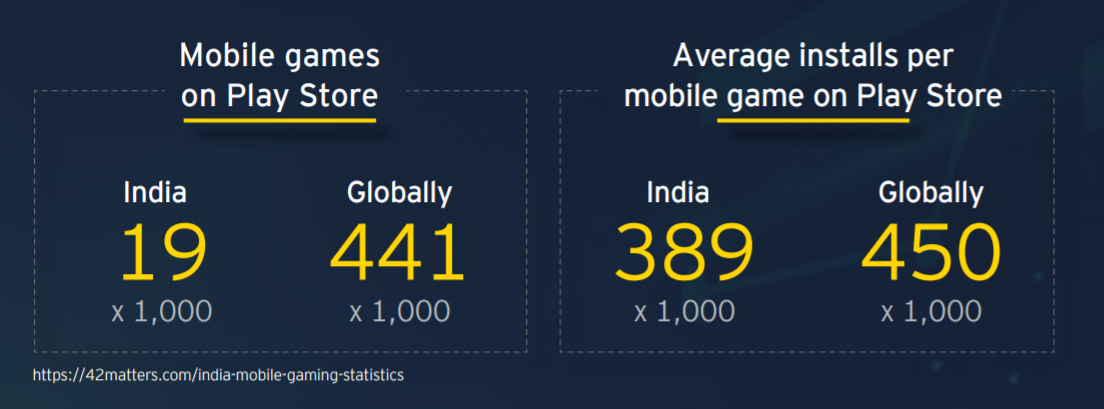

- While 86% of the installs on mobile games on the Google play store are from India, only 4% of the games are made by Indian developers. This presents a large opportunity for Indian game developers.

- India’s gaming industry has attracted over $1B USD in investment over the last 5 years from investors like Sequoia, Tiger Global, and TCV (early investor in Netflix).

- India accounted for 24% of PUBG’s total installations worldwide.When it was banned in 2020 it created a gaping hole in a rapidly rising industry that was quickly filled by Indian competitors.

Esports in India?

A few years ago, India’s e-sports industry was fiercely underdeveloped. It held just 25 developers, a few million viewers, and was roughly worth $200M USD as a whole.

Today there are over 400 game developers in the country, 27M viewers (expected to hit 85M by 2025), and its valued at almost $1B USD.

With the Rise of the Internet, India has vaulted to become one of the quickest growing mobile gaming industries in the world. Growing at a rate that will soon surpass than the music, movie, and television industries put together.

India’s gaming industry has attracted about $575M USD in investment between 2014 and 2020 (in addition to $400M USD raised by Dream11 and $90M USD raised by Mobile Premier League recently). From marquee investors such as Sequoia, Softbank, TCV, and Tiger Global who are betting on which player might fill the gap left by PUBG and become the next Epic Games of the east.

Over 50% of India’s population is below the age of 25, and 60% of the nation’s gamers are under 25 years of age. The gaming userbase surpassed 365 million in March 2020 and will continue to grow and mature.

What do you mean by the gap left by PUBG?

PUBG Mobile was initially banned in 2020 alongside hundreds of other apps because of connections to Chinese companies and investors.

Prior to the ban, the mobile battle royale game had more than 175 million installations from India, accounting for 24% of its total installations worldwide. This was when the esports industry was still growing in India, when rising stars like Mortal and Ronak were becoming the first real esports ‘superstars’ and competing on the world stage against China and Korea.

This level of global attention and fan fare, combined with COVID-19 and continually rising internet penetration rates + low data allowed PUBG to become of the center of a booming market in India on track to dominate the region.

When it was banned, it created a gaping hole in a rapidly rising industry that was quickly filled by Indian competitors. India itself accounts for 86% of the installs on mobile games on the Google play store (which makes sense considering its massive, android-based population). But only 4% of those games are made my Indian developers. This presents a huge gap in the global game development market that Indian developers are starting to exploit.

Creating a multi-billion dollar opportunity to create the worlds next Epic Games, Riot Games, and Activision Blizzard.

This gap between demand and supply will start to narrow. India now has over 400 gaming companies and 90 game development facilities thanks to the Government’s Make in India program.

Who might be the next game giant in India?

Startups on the Rise

While Youtube and Twitch dominates the global high-profile streaming market, there are a number of opportunities for local players to focus on the the streaming market in their specific regions. Multi-billion dollar industries on their own. Here are a few companies in India creating localized markets for these established verticals.

- Loco – a pioneer in the game livestreaming and esports sector in India, paving the way for gaming to go from a niche hobby to a mainstream national interest. Raised a $9M seed and backed by the creators of PUBG.

- Rooter – has over 7.5 million active users of which 3.8 million come from their app. Rooter, has been actively building its brand by signing contracts with star gamers like Gyan Gaming, who has 11 million subscribers on YouTube, and PVS Gaming, with the biggest subscriber base in South India.

- Revenant Esports – Looking to become the 100 Thieves of India, Revenant manages rising esports teams and players in India. Their current roster includes 25 players, many of which compete at the global level. It’s led by seasoned entrepreneur and investor Sajan Raj Kurup who has recently taken a majority stake in the early stage company.

- Skyesports – Founded in Chennai, Skyesports has become the one of the largest organizers of esports tournaments in India. Its marquis tournaments like Skyesports Championship, Skyesports League, Skyesports GrandSlam reached 10 Million Gamers and 65 Million Viewership 1.5 years after launching. They’ve recently gotten into talent management for top South Indian gamers.

Large Players Expanding their Reach

The most developed and accepted gaming market in India right now is sports and sports betting. These industries rose off the popularity of cricket but are starting to diversify into esports betting, tournament organizing, and mobile games. These players have large warchests, government connections, big investors, and are some of the original players in India’s internet economy. They have the ability to push the industry forward, but won’t be the niche innovators we see above.

- JioGames – No discussion about India is complete without talking about Jio. The internet giant launched Jio Games in 2020 to get into the rising esports industry. They’ve partnered with SEGA and Qualcomm to launch tournaments and have expanded their ecosystem by investing into quickly growing esports startups.

- PayTM First Games – Paytm launched their gaming division a few years back focusing on esports and fantasy sports. They’ve partnered with gaming giants including Riot, Garena, Supercell, ESPL for bringing the best of esports for Indian gamers. They have amassed 80M users and witnessed over 75,000 new users joining the platform every day during the lockdown in 2020.

- Dream11 – In April 2019, Dream11 became the first Indian “gaming” company to become a unicorn via. its fantasy sports platform. In August 2020, the company announced that it would be the 2020 title sponsor for the Indian Premier League, the world’s biggest cricket league. Recently, they raised a round of $400M USD led by Tiger Global and are expanding into the esports betting world with a few recent acquisitions.

- Nazara Technologies: Nazara technology is one of the largest esports company in India which was actively involved in the distribution of top games like World Cricket Championship. Nazara has also expanded into the market of India, Africa, Middle East, South East Asia and Latin America. However, they’ll face serious competition from Reliance Jio, Dream11, and MPL as the existing incumbent.

- Mobile Premier Gaming – MPL is an online fantasy sports platform for multi-category sports. It allows gamers to participate in eSports gaming tournaments. MPL currently has over 63.5 million users across India and Indonesia and is valued at $945M USD.

What could go wrong?

The biggest risk the esports industry faces in India are inconsistent and outdated laws, regulations, and taxation around gambling and sports betting. Not dissimilar from challenges that esports faces in the United States.

Each state in India has its own laws on gambling that were established in the 1900’s. This has lead to inconsistent regulations across the country. The way the laws work is that they classify games as ‘chance-based’ (considered as gambling) and ‘skill based’ (sometimes excluded from the gambling rules).

Because of this, many esports companies in India may be subject to anti-gambling penalties. Karnataka, Telangana and Tamil Nadu – three massive states – have already banned online real money gaming on the grounds that online games adversely impact the local population. In Tamil Nadu, any form of wager or online bets could lead to a fine of INR 5,000 with a six month jail sentence.

However, there are a number of other revenue streams for the esports industry outside of just sports betting. Specifically streaming and sponsorship revenue. Which are expected to grow from 2.5B INR ($33M USD) to 11B INR ($150M USD) by 2025. This doesn’t even consider the new industries that would form around Esports such as apparel, digital goods, tournaments, in-app purchases etc. While India may be behind in its development, it will quickly outpace the rest of the world in its growth.

As per the white paper, Understanding Value in Media: Perspectives from Consumers and Industry, engaged gamers are more likely to be game service subscription subscribers than other media and entertainment consumers. This created even more opportunities for revenue in the esports and gaming industry.

Opportunities and Startup Ideas

With an industry growing this fast, there are plenty of opportunities to start, grow, or invest in a company that builds of the momentum. You can find examples of organizations like these in other countries, but India has a better opportunity to create niche versions of them given how large the country is.

- Start a recruiting agency to find talented or up and coming esports players to match with clubs

- Start organizing in person esports micro-events, host talks, tournaments, workshops, training sessions etc.

- Focus on a specific language or niche within streaming, curate the livestreams of streamers who fit the profile and target your specific audience.

- Start a newsletter or publication specifically focused on esports news, pick a specific language, game, or vertical to focus on

- Create an esports ranking database that keeps track of the top esports players within India

- Build an Influencer marketing platform to connect brands with rising esports players

- Create a turn-key way for teams to create and sell digital or physical esports merchandise.

- Enable the easy creation of NFTs or dynamic NFTs for individual esports athletes

Further Reading

Here are 3 great reports that dive into details about India’s esports industry and the industry at large. I’d recommend adding these to your resource list if you’re interested in learning more about this industry

- The Dawn of Esports in India – Ernest Young

- Unpacking a Billion Dollar Industry: Digital games and sports in India – Ikigai Law

- Esports Ecosystem Report 2021 – Business Insider

Overall the esports industry in India has the potential to become one of the largest esports industries in the world. As the industry as a whole grows, there will be plenty of opportunities to build for niches and build services for mobile gamers in Tier 2 and Tier 3 cities by catering to language, customs, and finding talented gamers who are ignored by the mainstream.

If you liked this article, please consider giving it a “❤️” on Substack or subscribing using the button below!