What Latin America’s 20x increase in the use of stablecoins last year means for DeFi adoption and how China is pushing the world towards blockchain based currency.

Macro Media Lab is a bi-monthly report that dives into the biggest trends happening in emerging markets.

Subscribe to get the top reports and two deep dives a month.

Summary

Stablecoins are a type of cryptocurrency designed to have a stable price. There are multiple different types of stablecoins.

Countries like Argentina and Nigeria, who are going through a monetary crisis, are experiencing a mass adoption of stablecoins which is driving the global market further.

China’s development of a Central Bank Digital Currency (CBDC) will impact the global influence of the US.

China’s trade influence through the Belt and Road initiative will spur the adoption of the digital currency throughout Asia.

What is the future of payments?

In the previous article, we explored how DeFi is poised to disrupt the $100B unbanked market in emerging regions like LATAM, India, and Southeast Asia.

But there is a quickly growing subsection that you should be paying attention to – stablecoins and Central Bank Digital Currencies (CBDC’s). Two types of digital currency that lie on the spectrum between centralized and decentralized. Both are far easier to use that traditional cryptocurrencies for day to day transactions and both are quickly being adopted around the world, specifically in China.

We explain what they are and their implications on the broader economy below.

What is a stablecoin

While traditional cryptocurrencies like Bitcoin or Ethereum have a price that is constantly in flux, stablecoins are designed to have a stable price.

This makes them much easier to use for day to day transactions. You can buy or hold your savings in a stablecoin knowing that it wont suddenly lose its value.

Globally, stablecoins were worth more than $50 billion as of April 2021. But the earliest adopters aren’t here in the US or Canada. It’s in countries like Argentina that are facing heavy regulation, economic issues, or rapid currency deflation. We’ll dive into some of those case studies below before going into CBDCs.

How do they work?

The theory goes, if you create a currency that is ‘pegged’ or attached to a regular currency like the US dollar or something else with a relatively stable price, it will prevent price swings. From there four different types of stablecoins emerged.

Fiat-Collateralized: Backed by a currency like USD. These coins have a reserve of actual dollars in a bank account that gives them value. The best known coins are Tether (USDT), USD Coin by Coinbase (USDC), Binance USD (BUSD), and Diem by Facebook (formerly known as Libra, not yet released).

Commodity-Collateralize: Backed by a tangible asset like gold, precious metals, or even real-estate. These coins have the ability to appreciate over time as the assets increases in value. Some interesting ones are Digix Gold (DGX) backed by Gold, Tiberius Coin (TCX) backed by 7 different types of precious metals, and SwissRealCoin (SRC) that is backed by a portfolio of Swiss real-estate investments.

Crypto-Collateralized: Backed by other cryptocurrencies like Ethereum. These coins are over collateralized so they can absorb fluctuations in price. The best known one is MakerDAO (DAI) which uses Ethereum as collateral. These are the closes to true cryptocurrency.

Non-Collateralized: Backed by algorithms that increase or decrease the number of coins available to regulate the price. The best known one was Basis coin – which shut down in 2018 due to regulatory concerns. Some of the major ones on the market today are Ampleforth (AMPL), Empty Set Dollar (ESD), and Dynamic Set Dollar (DSD).

This video below by my wonderful friend Niloo from Blockgeeks, explains how each of them work in more detail:

Stablecoins in Latin America: A new way to get USD

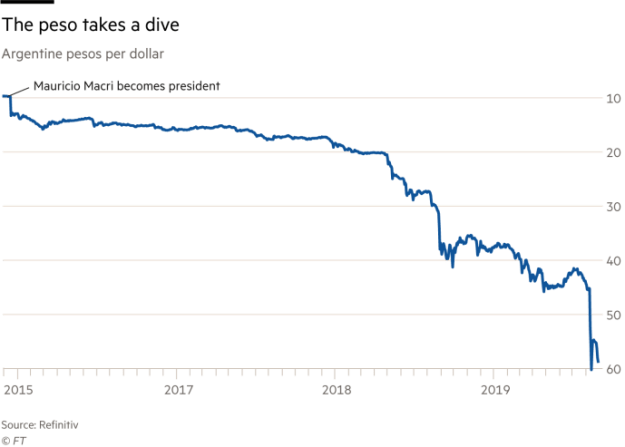

After the 2018 monetary crisis in Argentina. The Argentinian Peso collapsed by nearly 40%. Over 2019 and 2020, this started to spread to other regions in South America – getting worse once COVID-19 hit.

For the everyday person, any amount of savings that they held in Peso’s were rapidly losing value. If you held $1000 in January, by March it was worth $700. Citizens were rapidly converting their Pesos into USD to protect their savings. But when people rapidly sell their currency for a foreign one, it just decreases the value of their home currency even more.

To protect an economic collapse, the Argentinean government stepped in and placed a $200 monthly limit on the amount of USD citizens could buy. The idea was to slow the outflow of money, but it didn’t really work.

But because the currency continued to drop, a black market for US dollars arose. It was based on illegal street-based exchanges known as “caves” (or “cuevas” in Spanish) that have been around for years but saw a sudden boom. Thousands of windowless offices in the heart of the financial district of Buenos Aires popped up, allowing people to buy dollars or cash cheques, no questions asked – for a hefty fee.

Cueva: literally “cave” — an illegal office where dollars are changed at the unofficial rate. Sometimes they are legitimate exchange offices with an illicit side business.

Then stablecoins like USDC, Tether, and DAI entered the scene. DAI, being relatively unknown in the region started gaining popularity. It was an easy, convenient, and safer way for people to exchange their Pesos for something stable.

In 2020 stablecoin trading volumes exploded. Between March and May, MakerDAO saw trading volume of the DAI quadrouple from $5M a day to $20M a day. Stablecoins as a whole were trading up to 20x their volume by the end of the year. Business doing business in Latin America started accepting Bitcoin and Tether as payment.

That momentum is also carrying through to blockchain and cryptocurrency startups in the region, like Bitso, a Mexican cryptocurrency exchange that raised $62M last December.

If you’re curious, here is a list of 12 key crypto-exchange startups in the region

Bitso: Mexico

DaesX: Columbia

Volabit: Mexico

Panda Exchange: Columbia

Ripio: Argentina

Bitinka: Peru

Bitex: Argentina

Crypto Market: Chile

Mercado Bitcoin: Brazil

Buda: Chila

Cryptofacil: Uruguay

Livecoin: Belize

List from columbiafintech.co

What other countries have a similar story?

The monetary crisis in Argentina spurred the mass adoption of stablecoins and cryptocurrency throughout Latin America. Nigeria is facing the same situation and seeing widespread adoption of stablecoins as a means to protect their savings. China moved over $50B of crytocurrency to other parts of the world last year, likely to circumvent government limitations on how much foreign currency someone can buy.

Wherever there are economic challenges or government regulation, cryptocurrency starts to peak through. Taking us one step closer to the future.

Now on to topic #2 – Central Bank Digital Currencies.

What is a CBDC?

Last year the Chinese government passed legislation that banned any Yuan-based stablecoins. This is one part of its strategy in rolling out their own blockchain-based currency controlled by the central bank – a CBDC.

A central bank digital currency (CBDC) takes inspiration from the stablecoin but is closer to traditional currency than it is to cryptocurrency. It’s a fairly new concept with China being the front-runner, having experiments currently set up in three of its major cities – Shanghai, Guangdong, and Shenzhen.

A CBDC is a completely digital form of currency built on Distributed Ledger Technology (the tech that makes up blockchain). It is issued by a central bank and backed by a tangible asset, like actual physical currency – similar to a fiat-collateralized stablecoin.

The difference is that only the central bank has the ability to modify the ledger. This gives it the benefits of low fees and higher efficiency because there is no need for a middle man. While also giving the government control over how it works.

Why does this matter?

CBDCs are a complete redesign of money. In the way that the car disrupted transportation, digital currency has the potential to completely change the macroeconomic landscape, how we make purchases on a daily basis, and how countries interact with each other.

Being centrally controlled and digital, the government is able to monitor all payments and add other digital ‘features’ that can have big macroeconomic impacts. It’s a leaner, more efficient way of issuing currency both locally and overseas. Which means that the international monetary system dominated by the US might start to change.

We’ll dive into the pros and cons below.

China: The first state controlled digital currency (CBDC’s)

When Bitcoin first broke into the public realm over 10 years ago, China took notice. In 2014 it started the internal development of a national digital currency. In 2016 it announced an official division of the central bank called the Digital Currency Institute. Last year, it started trials in Shenzhen, Suzhou, Xiongan and Chengdu.

In these trails they would randomly ‘drop’ packets of $30 worth of Digital Yuan through the city via WeChat. If you were lucky enough to be a part of the trial, you could then use that Digital Yuan at a number of grocery, convenience stores, or restaurants like Starbucks and McDonalds in the area.

China is the first country to have successfully made moves towards a highly utilized digital currency. While the technical details have not been made available, some of the experiments have demonstrated that this digital currency provides economic value that you just cant get with regular money. Some examples that have been demonstrated are:

Issuing currency instantly to a geographic region (ie. if there is a natural disaster)

Adding an expiry date to new coins to ensure people spend them quicker (ie. adding an expiry date to a stimulus cheque to boost the economy quickly)

Tracking all payments that are made (ie. eliminating the use of black money or tax evasion)

This is a macroeconomists dream. Being able to instantly issue, and control currency allows the central bank to have much finer control over the economy and economic behavior. For example, if this was in the US during COVID. The stimulus could have been distributed instantly, and had an expiry date or restrictions only allowing citizens to spend a portion of the stimulus at local businesses. This level of control has never been seen on a large scale before.

However, because the digital yuan is controlled by its central bank, it misses out on one of the major draws of cryptocurrency: anonymity for the user. This allows the government to track all use of the digital currency throughout the country. While this is good for detecting fraud and illicit activity, it is detrimental for individual privacy.

On a global scale, four-fifths of the central banks in major economies have begun research and development on central bank-backed digital currencies, including Russia, the US, Saudi Arabia, and the UK. You can find the most up to date map from the Atlantic Council here.

Impact on geopolitics

The real value in CBDCs for China is in its international impact. Right now, only 4% of the international market uses Yuans, compared to the 88% using the dollar. This economic influence is what gives the US its global strength. Cutting off the supply of dollars to a country means that you cut it off from doing business with the world. This is what the US does when it applies sanctions to countries that it deems a threat. It is also able to pressure individual banks to freeze accounts and block the transfer of funds through a practice called “dollar weaponization”.

This excerpt from the Wall Street Journal best explains how that works:

The U.S., as the issuer of dollars that the world’s more than 21,000 banks need to do business, has long demanded insight into major cross-border currency movements. This gives Washington the ability to freeze individuals and institutions out of the global financial system by barring banks from doing transactions with them, a practice criticized as “dollar weaponization.”

American sanctions on North Korea and Iran for nuclear programs hobble their economies. Swiss banks abandoned their famous secrecy eight years ago to avoid Washington’s wrath in a showdown over taxes. After the February coup in Myanmar, the U.S. used sanctions to block the movement of top military officials’ financial assets through banks. The Treasury’s database of sanctioned individuals and firms—the “Specially Designated Nationals and Blocked Persons List”—touches virtually every nation on earth.

Digitizing the Yuan alone won’t create an issue for the US. But if it gains traction outside of China then it could. Because the Digital Yuan exists on its own network. it gives people a way to exchange money without the US knowing about it. Exchanges wouldn’t need to use SWIFT, the messaging network that is used in money transfers between commercial banks that is dominated by USD. They would have a new network without the existing US influence.

Similar to stablecoins, the digital yuan would provide options for people in the developing countries surrounding China to transfer money internationally and have a more stable alternative to their local currency.

Because it’s government controlled, and China excerts a large influence on the surrounding region through trade, it would be more widely adopted making it a more popular choice than a stablecoin. Especially within the 65 countries of the Belt and Road initiative overseen by China. Or within the numerous regions in Africa, India, or South America that China has been investing into.

China has also started to create partnerships with countries like the UAE to solidify the presence of the Digital Yuan internationally and create a new international exchange.

Will CBDCs affect the cryptocurrency market?

With more than 95% of Crypto futures activity stemming from Asia, it’s unclear the impact what the impact of the governments push towards CBDCs in the region might be on the cryptocurrency market as a whole.

Chinese citizens are already banned from converting yuan to crypto but the practice continues under the table using Tether, a dollar- backed stablecoin. The money parked in Tether then gets routed to Bitcoin and other tokens then transferred across the world.

But if the government goes further and issues more limitations or crackdowns on the illegal exchanges, it may create a significant impact on cryptocurrency demand globally.

What now?

Between Stablecoins and CBDCs, the way we use money will completely change in the next 5 years. The regions to keep a close eye on are South East Asia (if China’s CBDCs start to gain traction, they will start spreading throughout the region), Latin America, and Nigeria (strong DeFi adoption due to financial crisis).

If you found this breakdown valuable, share this article with one friend who you think could learn from it. As always If you liked this article, please consider giving it a “❤️” on Substack or let me know what you think by leaving a comment below!