Social commerce in China is on a whole different level. It’s creating new markets that are rapidly spreading across the emerging world.

Macro Media Lab is a bi-monthly report that dives into the biggest trends happening in emerging markets.

Subscribe to get the top reports and two deep dives a month.

Summary

Social commerce started in China and is now eating the world, spreading quickly across emerging and developed markets

It’s pioneered new concepts like social selling, group discount purchasing, and farmers using livestreams to sell massive amounts of produce directly to consumers

Similar business models have popped up in Indonesia’s $25B and India’s $70B social commerce markets with unique niches like Muslim-focused apparel, maternal and baby care products, fast-moving consumer goods (FMCGs), fashion, groceries, and more.

What’s happening in China?

In 2018, The Lipstick King of China – “Austin” Li Jiaqi, appeared side-by-side with and then outsold Jack Ma, selling 15,000 lipsticks in just five minutes. Then, in 2019, he helped drive $US145 million in sales on e-retailer Taobao during China’s Singles’ day through a live streaming event. Today – he’s been named as one of Time Magazine’s Next 100 Most Influential people for pioneering China’s $15B live-streaming e-commerce market. Sound like some weird one-off trend? It’s not.

China is light years ahead of the world when it comes to finding new ways to bring online shopping to the forefront. A few quick stats about China that you should know:

Social commerce was poised to comprise more than 30% of the country’s entire online retail business in 2020 – 10x that of the United States.

Gen Z represents 13% of household spending, relative to just 3% in the US.

An entire industry has propped up around training new influencers to sell products through social channels, some of who have sold >$100M worth of products through their online stores

What is Social Commerce?

Social commerce is the process of selling directly through social networks (Whatsapp, WeChat) and social media (Instagram, TikTok). You’ve probably already come across examples of this with influencers on Instagram – where you can buy the products they’re wearing or using directly through the app.

This all seems new, but it’s actually a tiny, outdated part of the massive social commerce movement that was pioneered in China. Which is lightyears ahead of the United States and spreading quickly across the emerging world.

What are the main types of social commerce platforms?

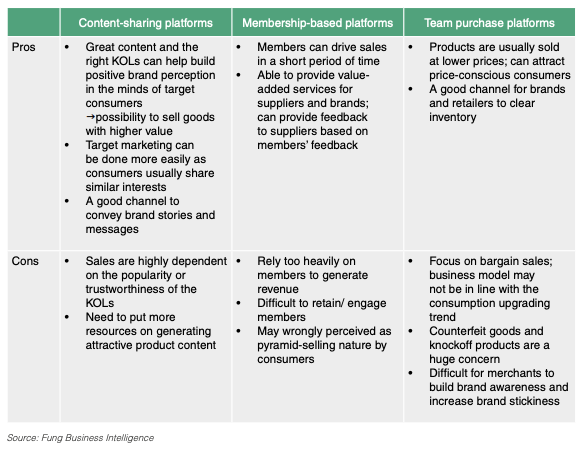

The core social commerce industry in China can be split into three categories. I’ll explain each of them in depth below.

Content Sharing

Membership Based

Team Purchase

1. Content Sharing

This is the main form that you’re likely used to. As the name implies, content is the key focus on content sharing platforms. These are platforms like TikTok, Instagram, Kuaishou, and Facebook who heavily rely on user-generated content and predictive algorithms.

Content is typically short, entertaining, video-based, and contains links that allow you to directly purchase the products. A recent research by BCG and Tencent shows that almost half of Chinese luxury shoppers receive information about brands through influencers/key online leaders (KOLs’) posts on social platforms and brands’ social media accounts.

But this goes far beyond a new bag or shoes. Non-traditional DTC industries, like agriculture, have started to thrive on the platforms. Farmers and fishermen have quickly become live-streaming stars in China. Showing off juicy oranges or thick lobsters to thousands of viewers. One mango farmer actually sold 30,000kg of fruit in two minutes through a live stream to 25 thousand viewers.

Key Players

TikTok

Instagram

Snapchat

Key Components

Influencer/KOL training camps (explained below)

Seamless Integration (Shopify, Alipay, WeChat Pay)

Mobile-first content

Strong delivery networks

Live Streaming

2. Membership Based

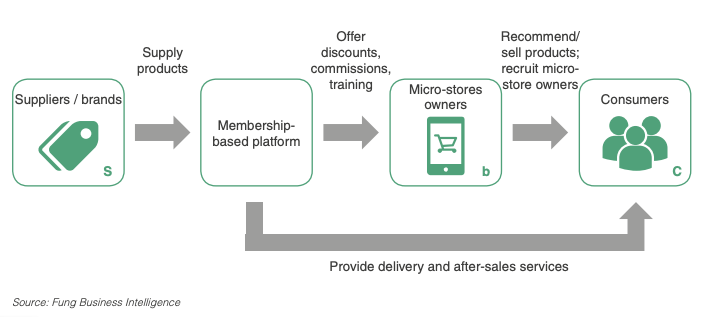

Pioneered by apps like Yunji and Beidian, membership based social commerce is like a completely digital, end to end version of Costco. Traditionally, Costco charged small business owners a membership fee for exclusive access to discounted products in bulk. These small business owners would then resell the items to end consumers.

Yunji pioneered a new business model (S2B2C) that allows individuals (“micro-store owners”) to pay a membership and receive exclusive discounts and products from suppliers. Those micro-store owners then sell those products to their social contacts (“consumers”) on WeChat. The delivery of products and any after-sale service is centralized and taken care of by Yunji. This model allows Yunji to capture value at every part of the funnel and leverage micro-store owners to expand their reach into a wide variety of end consumer groups and social networks.

Yunji also incentivizes micro-store owners to recruit other store owners and new end consumers to the platform by offering them rewards. This has allowed people to start side hustle’s where they sell sunscreen, snacks and lots more to their followers on WeChat.

Major Players

Yunji

Beidian

Daling Family

Key Components

Subscription-based discounts

New Supplier to Business to Consumer (S2B2C) business model

Leverages social selling through whatsapp & wechat

3. Team Purchase

This is arguably the most innovative section of social commerce that has captured price sensitive consumers in Tier 3 & 4 cities. Team or group purchase apps allow consumers to get discounts on products when they buy in a ‘team’. The larger the team, the higher the discount. Teams have to be formed with at least two people (one initiator and one participant). Once the team creates a purchase order through an app like Pinduoduo (PDD) or JD.com, they are shared among the initiators’ “circle of friends” on social media allowing more people to jump in on the discount.

This level of virality has propelled PDD to the forefront of one of China’s leading social commerce companies. It’s business model is being replicated in a number of emerging markets with high density populations and price-sensitive consumers. It works especially well for household and agricultural products, where the brand doesn’t play as much of a role. At one point selling almost $1B worth of food in 12 days – a feat that is putting it on track to disrupt the way people buy food in emerging markets.

A few key factors needed for group selling to work

Focus on commoditized goods

High density, price sensitive consumers

Strong delivery infrastructure

Seamless mobile payments and access to a social graph

Markets nearby that easily that meet these criteria

India

Indonesia

Thailand

Major Players

Pinduoduo

JD.com

Alipay + TaoBao

Who are up and coming players outside of China?

While only some aspects of social commerce have been replicated slowly in the US – emerging markets are primed for explosive growth given that they match many of the same criteria that made social commerce grow in China. Countries like India, Indonesia, and Thailand are experiencing large rates of mobile-first internet connectivity, an increase in buying power, and more developed logistics infrastructure.

India is projected to have a $70B social commerce market by 2030 and Indonesia is projected to have a $25B market with unique niches like Muslim-focused apparel, maternal and baby care products, fast-moving consumer goods (FMCGs), fashion, and groceries.

Here are some examples of up and coming companies from those two regions. Most of them are at the Series A stage with recent raises in 2019 and 2020.

Indonesia

India

What core shifts has it created?

This dramatic shift in how people interact with ecommerce has created new industries and norms that can be taken advantage of.

Influencer/Key Opinion Leader Training

Massive businesses have been built around Key Opinion Leaders and as multi-channel networks. They focus on travelling the country identifying and training young people who could be potential content creators for client brands. One example is, Ruhnn ($RUHN), a Chinese company that raised $125 million in an IPO in 2019.

Targeting consumers not won over by large international brands (Tier 2-4 cities)

I’ve spoken about this in depth in the Indian market here. But many emerging countries like Indonesia, Brazil, Thailand, etc. have a similar tiered city system. In China, given their very recent development and mobile-internet access, these citizens have not yet been won over by international brands. Leaving a white space for Chinese brands and their social commerce partners. As Pinduoduo has shown, massive companies can be built by targeting specific geographies and socioeconomic groups. Similarly, Yunji, which IPO-ed in 2019, targets 3rd and 4th tier cities.

Mobile-First Integrations, Cross-Ecosystem Partnerships

WeChat and other “super apps” in the east have successfully integrated multimedia content and social networks with shopping and payment platforms. A feat that the US is only starting to crack with initiatives like Instagram’s Shops and the new partnerships between Shopify and TikTok.

Even after these initial integrations, Chinese super apps have a greater tendency and ability to become verticalized because of how many different business units they can cross promote. For example, Alibaba launched Connect to court influencers to create content for AliExpress merchants on video platforms like TikTok and Taobao using AliPay to purchase them. Similarly, Pinduoduo, which began as a group buying platform has recently moved into live streaming through leveraging WeChat rooms.

Video based content

Because of China’s mobile first nature, consumers are much more accustomed to taking and watching videos on their smartphones. Videos have the same draw and convenience in China as photos have in the US, making China a hotbed for live streaming and other video based content, including commerce oriented content. Additionally, many members of Tier 3 & 4 cities speak varying languages and are not as literate as other citizens. Videos are able to cut through these barriers by providing a visual medium.

How can I take advantage of this?

Add the publicly traded ‘baby amazons‘ of emerging countries to your watchlist. Many of them are well positioned to benefit from the rise in social commerce in their regions.

Use the Pinduoduo ‘price chop‘ as a way to get your customers to market your product, or build a plugin that lets you do it.

Bring non-traditional commerce (like farmers) into the digital content & DTC world. Make it easy for them to connect with KOLs and/or create content themselves.

Invest into early stage companies focusing on developing the KOL space in emerging markets, or develop one yourself.

Have any other ideas? Leave a comment below! If you liked this article subscribe to get the latest ones sent straight to your inbox twice a month!