Over the last 5 years, India has grown to become a hidden internet superpower. Creating billion-dollar battlegrounds between the world’s biggest companies.

Over the last 5 years, India has grown to become a hidden internet superpower. Creating billion dollar battlegrounds between Amazon and Walmart, Netflix and Disney, and every other technology company looking to become a dominant player on the world stage.

The secret behind that transformation is a sharp rise in the number of internet users, from 5% of the population in 2010 to 50% today (639 Million). Creating a group of digital consumers more than twice as large as the number of people in the United States. Rivaled only by China, which sits at roughly 900 Million. But much more open to the world.

How did this start?

Indian cities can traditionally be separated into 3 main tiers:

- Tier 1: Cities that have traditionally been connected to high speed internet. People here live in the city centers and are often wealthier than the average population (250 Million People)

- Tier 2: Cities outside of the core population hubs. Low speed internet, if any (500 Million People)

- Tier 3: Villages or small semi-urban cities, little to no access to internet (600 Million)

Traditionally, cities in Tier 1 India were connected to the internet and powered by the major 3 telecom providers: Vodaphone, Airtel, and BSNL. This created small pockets of internet connectivity across the country, centered in the major cities. The internet connectivity in these areas was similar to what we would experience in North America. Built on broadband and direct cable connections, accessed through WiFi, and accessible only to those who can afford it.

Since it was only 3 major companies that controlled the market, and there was enough money to be made by focusing on the wealthiest 20% of the country, no one really bothered to invest heavily into other areas of the country – until 2015 when someone new came in and shook the game up.

Mukesh Ambani, the single richest man in India and 7th richest person in the world, launched a company called Jio on December 2015. A new internet provider with the mission of providing internet access to the entire country. Why should you care? Because within 5 years, they completely dominated the market, created a network of super apps, and solicited a massive $5.7B investment from Facebook (its second largest investment ever) and $4.5B from Google.

For context, Mukesh Ambani is worth $70.1B and recently overtook Warren Buffet on the world richest person list (he now sits at #5). He has deep political ties with the India government, owns a 27 floor mansion in the heart of Mumbai, and runs Reliance Industries – India’s second largest company.

In its first month Jio took the country by storm, adding 16 million subscribers. In its second, 20 million. Soon it started growing faster than any other technology company in history – surpassing both Facebook, Twitter, and TikTok. Within two years, and Jio has surpassed all 3 of the existing telecom providers and created a network of 373 Million customers (which is almost 1.5x more than all the internet users in the united states),

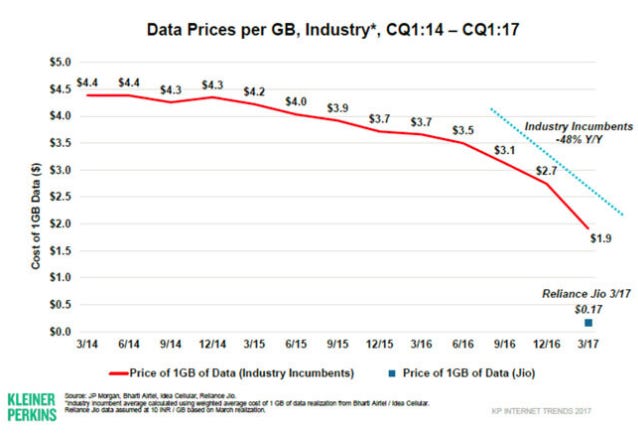

Their secret? Free data plans to half the country.

The Rise of Jio

With most of the main competitors focused on Tier 1 India, Ambani took a different route. He used $35 Billion, taken from the Reliance Industries war chest to build the biggest network of 4G cell towers the world has ever seen, spanning across 18 000 cities and 200 000 towns in India. He built this new internet empire in a completely new way – mobile first, equipping its users with the clunky looking JioPhone. A smart-enabled phone that gives users access to 4G LTE, Facebook, Whatsapp, Jio’s own suite of apps, and the ability to download and use other apps like YouTube. At a price that anyone could afford (~$20).

Along with this, Jio gave out 6 months of free data and calling to all of its new users.

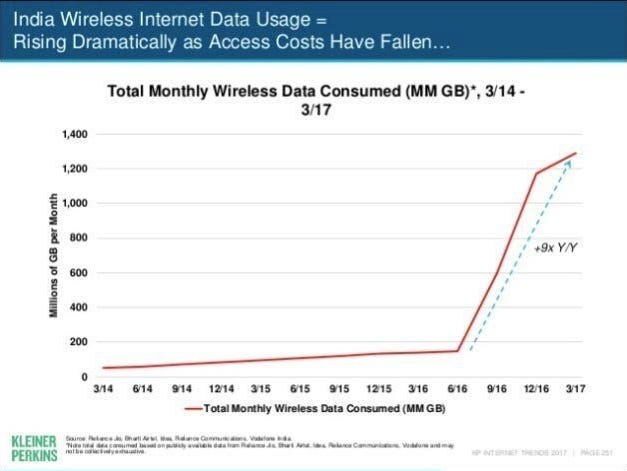

It started in Tier 2 and Tier 3 India, but once its service started creeping into to the Tier 1 cities like Mumbai, people couldn’t resist. Like my cousin, Zeenia a marketing professional in Mumbai who dropped her existing phone plan for Jio. Because all of Jio’s cell towers were built on 4G, the service was considerably better than any of the other three old telecom providers who hadn’t invested in their 2G & 3G cell towers. Jio’s strategy was to gather a large volume and undercut their competitors on the price of data. This was so effective that they single handedly turned data into a commodity in India, which is now home to the world’s cheapest mobile data plans

Fast forward two years later, and Jio has created a massive network of users both rich and poor. Most of whom had never been able to use the internet before and were now using their Jio phones to browse Youtube videos, watch movies, and talk to eachother through Facebook’s Whatsapp. This has caused ripple effects in everything from geopolitics to rising internet trends. As innocent as T-Series, an Indian music label, becoming the #1 most subscribed channel on Youtube or as sinister as political parties pumping fake news across the country through Whatsapp groups to millions of new, uneducated internet users.

But it doesn’t stop there.

Jio operates an ecosystem of apps that function on their mobile network and come pre-installed on all their ‘Jio’ phones (that have recently overtaken Samsung as the dominant phone provider in India). These apps include Jiochat, JioCinema, JioMusic, JioMoney (to send money and pay bills), JioCloud (file storage), and JioHealth.

Most important out of all of these, is JioMart – Reliance’s new play into the ecommerce market to take on both Amazon and Flipkart (owned by Walmart) who have both made aggressive moves into India within the last 3 years. JioMart and the ecommerce space is worth an article on its own, but most recently secured a $5.7B investment from Facebook for a 10% stake in Jio (April 2020) with plans on connecting JioMart with Whatsapp to directly connect India’s staple mom and pop shops (which make up 90% of india’s grocery market) with Indian users right in their area. Many of whom already use Reliance-made point-of-sale systems.

What’s next?

This emergence of the internet spearheaded by Jio is changing every single market in India making the world second largest country, a new battleground for the internet companies of the world and producing its own global competitors like Ola, PayTM, and Flipkart.

This series of articles will dive into those industries and break down the basics. Providing you with the knowledge and tools to predict how the world might start to change over the next 5 years.